Adani Wilmar raises ₹940 crores from Anchor Investors ahead of IPO

Written by Lucky Wilson | KJMM.COM on January 25, 2022

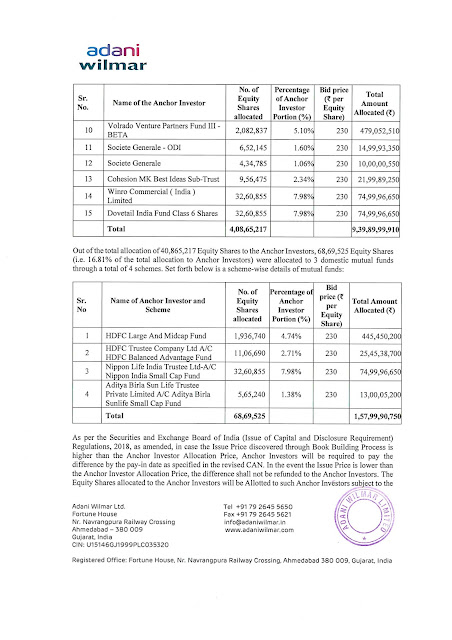

India’s leading FMCG and Adani Group of Companies Adani Wilmar raised ₹940 crores from anchor investors on January 25, Tuesday before the IPO. The Adani Wilmar IPO is to open on January 27, Thursday. The company allotted a total of 4,08,65,217 equity shares to 15 Anchor investors at an upper price band of ₹230. The anchor investors list includes 3 Mutual Funds through a total of 4 schemes. The company is going to raise ₹3600 crores. Check out the final list of Adani Wilmar Anchor Investors given below:

Adani Wilmar Anchor Investors List:

The IPO Committee of the Company at their meeting held on January 25, 2022, in consultation with ICICI Securities, BNP Paribas, Kotak Mahindra Capital, JP Morgan, and BofA Securities (“GCBRLMS”), and HDFC Bank, and BNS Paribs (“BRLMs”), (GCBRLMs and BRLMS) are collectively reffered as “Managers”) have finalized allocation of 4,08,65,217 equity shares, to Anchor Investors at the Anchor Investor Allocation Price of ₹230/- per Equity Share (including share premium of ₹229/- per Equity Share). The details are given below:

The Adani Wilmar IPO to open on 27 January and close on 31 January 2022. The price band is fixed at ₹218 to ₹230. Adani Wilmar IPO application minimum bid is for 65 Shares (₹14,950) and the maximum bid is 845 shares (₹194,350). The Book Running Lead Managers of the IPO are ICICI Securities, HDFC Bank, BNP Paribas, Kotak Mahindra Capital, JP Morgan, BofA Securities and Credit Suisse.

To know more about latest IPO gmp please visit correctsuccess.com

KVSP

KVSP